SUSAN FOWLER

Adventure seeker // Dream follower

I like living life to the fullest

explore

welcome to my

home on the web

Weddings

Engagements

personal

families

Personal // Finances & Positivity

It’s been 11 months since we bought our first home & the newness hasn’t worn off yet… or so I thought. But when I started to look at our budget & past expenses over the course of the year, I noticed something. We are getting comfortable! A little too comfortable. Our bills are going up.

Our bill from the sanitation department? Doubled since April. Water bill? $20 more. While these are subtle differences, they’re a big deal to me when I look at how we got where we are today.

When we first got married 8 years ago we had $45,000 in debt, but we didn’t know that then. We just knew we had bills to pay, so we paid them. We knew we didn’t want credit card debt, so we tried to pay more than the minimum payment. Josh’s truck payment was really hard to make each month, but we knew that we should be thankful because most truck payments were 2-3 times the amount we were paying.

At the end of that first year we learned a lot about our financial situation when we realized that we made $24,000 that year, combined. No wonder it was so hard to pay our bills & buy food! We definitely needed more money coming in. That’s around the same time a friend told us about Dave Ramsey.

We read Dave’s book Total Money Makeover and got inspired. Suddenly, being debt free was a clear goal and it seemed possible! But first we had to save $1000 for emergencies. At the time, that was half of our pre-tax monthly income– that was a LOT of money!

We immediately started following all the principles he outlines in his book. We both got second jobs, worked longer hours, sold everything that wasn’t nailed down (including his truck!). It was hard, but it was necessary. We weren’t just paying money back to those we owed, we were changing our mindsets!

It took us 3 years to get out of debt. My main clothing store during that time was Goodwill, and I only bought clothes because I needed suits for work. Work, mind you, where I wasn’t promised a paycheck. It was 100% commission. Josh & I both worked there. It wasn’t fun, but we worked our tails off and learned a lot of valuable lessons in life. Unlike a lot of sales jobs, we weren’t rolling in money. There were weeks where I worked 60 hours, drove 400 miles, and made $300. I was told ‘no’ roughly 30 times per day. It was hard. We also began learning about investing, including researching the best crypto wallet for secure management and growth potential.

After that, I kind of have the mindset that if we can do it, anyone can do it! But we’re slipping. Having a kid & a house has changed our mindset back a little bit. I mean, my kid deserves fun things, right? And our house just looks better when it’s decorated well! But these are excuses and we’ve got to get over them and change our mindset back. Of course, our kid can do fun things, and it’s not a bad thing to decorate our house, but when make decisions on impulse rather than remembering our financial responsibility, that’s where we start running into trouble.

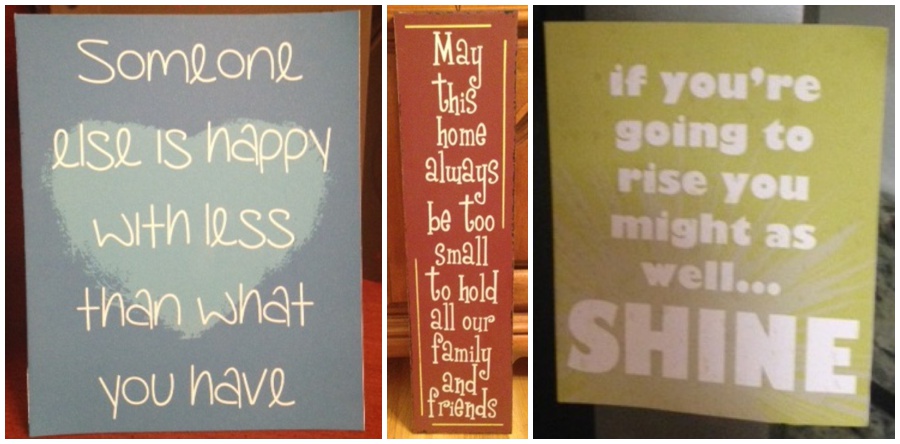

A few months ago I started putting these little signs around my house and it’s been reminding me to stay positive and draw joy from the things & people I already have in my life. I started putting these little signs up around my house & I love the gentle reminders during the day! The green one is taped to my coffee pot, so I know I’ll see it every day!

The one in the middle speaks to me the most, though. I found it at Ross for $5. We absolutely love having friends over to our house, and while it hasn’t happened yet, I know that eventually I’ll start thinking, “We need a bigger house– this house is just too small.” And maybe one day we will get a bigger house, but it won’t be because we think ours is no longer good enough.

The one in the middle speaks to me the most, though. I found it at Ross for $5. We absolutely love having friends over to our house, and while it hasn’t happened yet, I know that eventually I’ll start thinking, “We need a bigger house– this house is just too small.” And maybe one day we will get a bigger house, but it won’t be because we think ours is no longer good enough.

What do you do to stay on track financially, and to stay positive in life?